Learn About FICA, Social Security, and Medicare Taxes

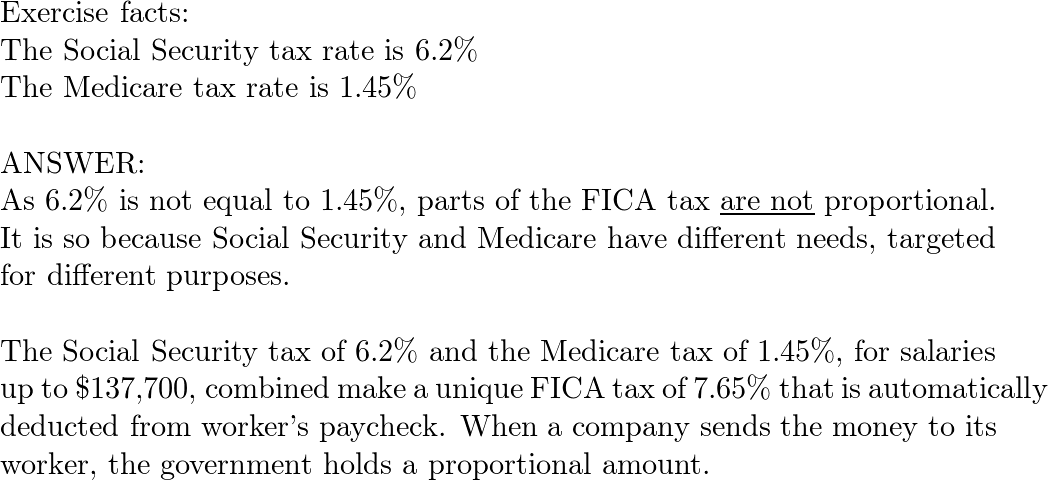

Por um escritor misterioso

Last updated 23 dezembro 2024

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn about what FICA taxes are, withholding Social Security and Medicare taxes from employee pay, and how to calculate, report, and pay FICA taxes to the IRS.

What is the FICA Tax and How Does It Work? - Ramsey

What is FICA Tax? - The TurboTax Blog

Maximum Taxable Income Amount For Social Security Tax (FICA)

Social Security and Medicare • Teacher Guide

Mastering Tax Withholding and FICA: A Financial Strategy Guide - FasterCapital

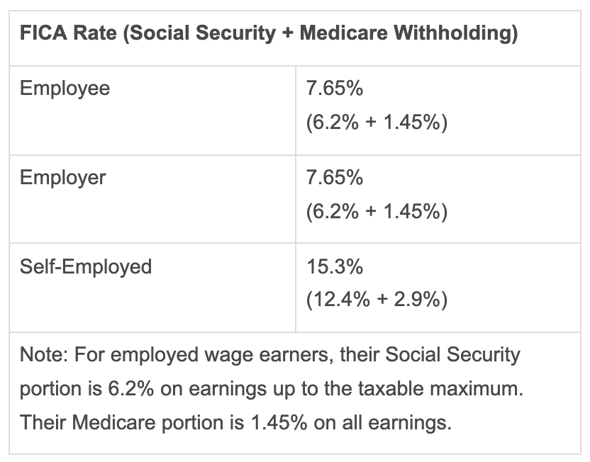

The Social Security tax rate for employees is 6.2 percent, a

FICA Tax Exemption for Nonresident Aliens Explained

What Are FICA Taxes And Why Do They Matter? - Quikaid

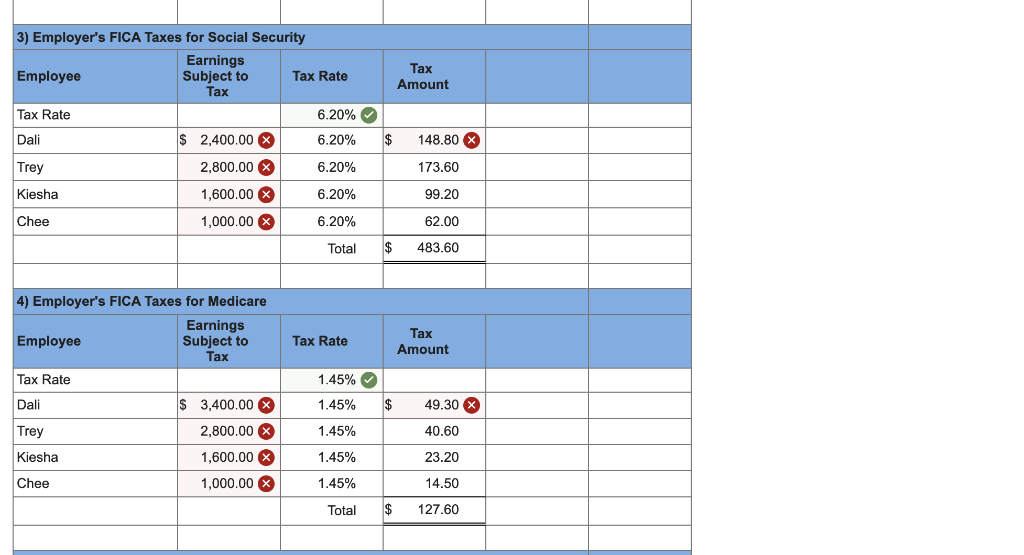

Solved Paloma Co. has four employees. FICA Social Security

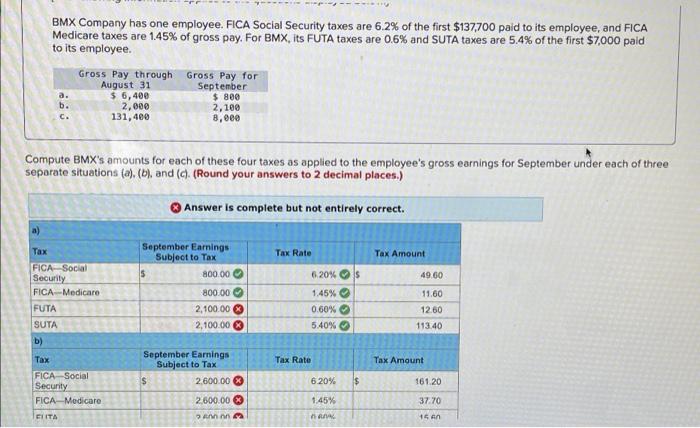

Solved BMX Company has one employee, FICA Social Security

Federal Insurance Contributions Act - Wikipedia

2021 Wage Base Rises for Social Security Payroll Taxes

2021 Wage Cap Rises for Social Security Payroll Taxes

Recomendado para você

-

What is FICA23 dezembro 2024

What is FICA23 dezembro 2024 -

What is FICA Tax? - Optima Tax Relief23 dezembro 2024

What is FICA Tax? - Optima Tax Relief23 dezembro 2024 -

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations23 dezembro 2024

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations23 dezembro 2024 -

What Is FICA Tax: How It Works And Why You Pay23 dezembro 2024

What Is FICA Tax: How It Works And Why You Pay23 dezembro 2024 -

What is the FICA Tax Refund?23 dezembro 2024

What is the FICA Tax Refund?23 dezembro 2024 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software23 dezembro 2024

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software23 dezembro 2024 -

How An S Corporation Reduces FICA Self-Employment Taxes23 dezembro 2024

How An S Corporation Reduces FICA Self-Employment Taxes23 dezembro 2024 -

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com23 dezembro 2024

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com23 dezembro 2024 -

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books23 dezembro 2024

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books23 dezembro 2024 -

Students on an F1 Visa Don't Have to Pay FICA Taxes —23 dezembro 2024

Students on an F1 Visa Don't Have to Pay FICA Taxes —23 dezembro 2024

você pode gostar

-

Reply to @layton.innit HERE IT IS (who else?) #tubbo #tuboo23 dezembro 2024

-

Modern Warfare 2 Beta Feedback & Changes: Devs Explain Mini-Map23 dezembro 2024

Modern Warfare 2 Beta Feedback & Changes: Devs Explain Mini-Map23 dezembro 2024 -

Pixel Papercraft - Heart Of Ender with Light Effect (Minecraft23 dezembro 2024

Pixel Papercraft - Heart Of Ender with Light Effect (Minecraft23 dezembro 2024 -

1 Unidade Modelos De Brinquedos De Papagaio Brinquedos Infantis Pássaros Artesanato Modelo De Figura De Papagaio Decoração De Mesa Peônia Papagaio Plástico Área De Trabalho Filho : : Brinquedos e Jogos23 dezembro 2024

1 Unidade Modelos De Brinquedos De Papagaio Brinquedos Infantis Pássaros Artesanato Modelo De Figura De Papagaio Decoração De Mesa Peônia Papagaio Plástico Área De Trabalho Filho : : Brinquedos e Jogos23 dezembro 2024 -

Buy Mass Effect 2 Digital Deluxe Edition EA App23 dezembro 2024

Buy Mass Effect 2 Digital Deluxe Edition EA App23 dezembro 2024 -

GTA 5: all the big headlines, all the trailers & screens, everything here23 dezembro 2024

GTA 5: all the big headlines, all the trailers & screens, everything here23 dezembro 2024 -

Gabe Newell gets an email from angry Steam user, sends a classy23 dezembro 2024

Gabe Newell gets an email from angry Steam user, sends a classy23 dezembro 2024 -

animestc.net at WI. AnimesTC - O melhor dos Animes chega primeiro23 dezembro 2024

animestc.net at WI. AnimesTC - O melhor dos Animes chega primeiro23 dezembro 2024 -

Roblox keeps crashing when I am in a game. It used to crash only a few times after I have played a game for awhile, but now it is constantly either a23 dezembro 2024

Roblox keeps crashing when I am in a game. It used to crash only a few times after I have played a game for awhile, but now it is constantly either a23 dezembro 2024 -

Ted Lasso' Barbie collection: See dolls inspired by the Apple TV+ comedy23 dezembro 2024