CMBS and Commercial Real Estate Implications of a Kohl's Takeover

Por um escritor misterioso

Last updated 10 novembro 2024

Key Takeaways: Kohl’s plans to open smaller stores and transition away from department store formatThe highest concentration of Kohl’s lease expirations occurs in 2024 impacting $815 million in CMBS debtCMBS exposure to Kohl’s totals approximately $5 billion Speculation surrounding Kohl’s and its future as a public company has been active during Q1 2022. In early-March

Women-Owned Vet Group To Open Clinic in Frederick, Md. – Commercial Observer

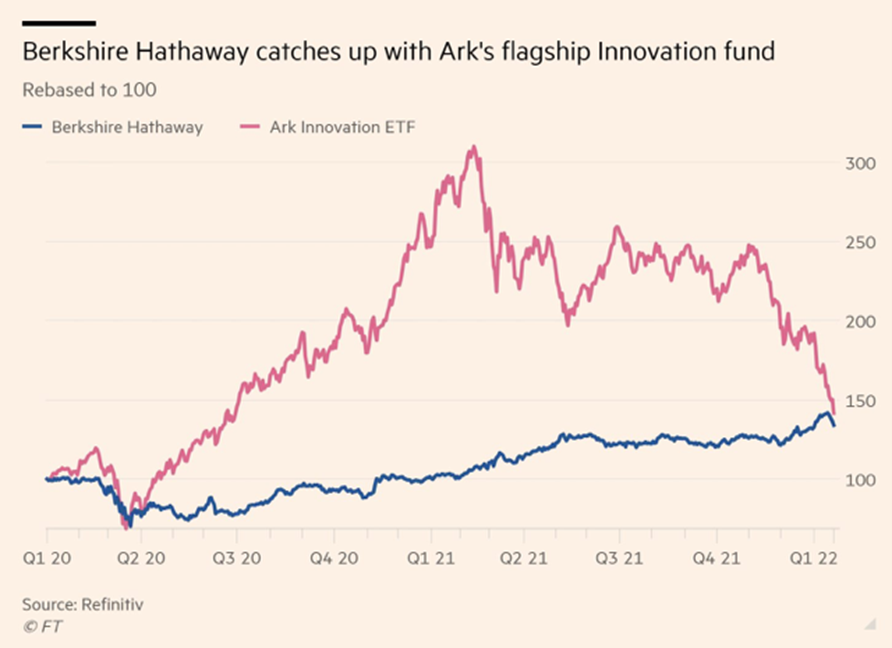

CMBS vs. CRE CLO: An evolving matchup

Boston - The Real Reporter

Calaméo - The Real Deal Retail Supplement 2018

What real estate risks mean for commercial mortgage-backed securities

Kohl's Fields Takeover Offers Despite Low Customer Foot Traffic in 2021 – Commercial Observer

Press Release Archives - Page 2 of 10 - Mission Capital

Clear Capital Clear Capital Admin

Miami Commercial Real Estate News, Trends, Observations • Page 2 of 105

CMBS Implications of Potential Kohl's Takeover – Commercial Observer

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ZO6DFK5FHFPDFN6BTD3U2GJRYY.jpg)

Activist investor, takeover talk heap pressure on Kohl's Corp

Recomendado para você

-

Kohl's (@Kohls) / X10 novembro 2024

Kohl's (@Kohls) / X10 novembro 2024 -

Kohl's cuts profit forecast, becomes latest retailer to warn of inflation pain10 novembro 2024

Kohl's cuts profit forecast, becomes latest retailer to warn of inflation pain10 novembro 2024 -

Tom Sachs x NikeCraft General Purpose Shoe Kohl's Drop10 novembro 2024

Tom Sachs x NikeCraft General Purpose Shoe Kohl's Drop10 novembro 2024 -

Kohl's (KSS) Rises as CEO Measures Show Signs of Business Improvement - Bloomberg10 novembro 2024

Kohl's (KSS) Rises as CEO Measures Show Signs of Business Improvement - Bloomberg10 novembro 2024 -

Kohl's Gets $9 Billion Bid From Starboard Value Group - WSJ10 novembro 2024

-

Kohl's overhauling image in hopes of a different fate than retailers like Sears, Kmart10 novembro 2024

Kohl's overhauling image in hopes of a different fate than retailers like Sears, Kmart10 novembro 2024 -

Kohl's Sephora Partnership Is Working, But Maybe Not For Long - Bloomberg10 novembro 2024

Kohl's Sephora Partnership Is Working, But Maybe Not For Long - Bloomberg10 novembro 2024 -

Kohl's announces opening date for Morgantown store10 novembro 2024

Kohl's announces opening date for Morgantown store10 novembro 2024 -

Kohl's unveils plans for store in downtown Milwaukee10 novembro 2024

Kohl's unveils plans for store in downtown Milwaukee10 novembro 2024 -

Kohl's Closing In on Naming Permanent C.E.O. - The New York Times10 novembro 2024

Kohl's Closing In on Naming Permanent C.E.O. - The New York Times10 novembro 2024

você pode gostar

-

Ketsuryugan GIF - Ketsuryugan - Discover & Share GIFs10 novembro 2024

Ketsuryugan GIF - Ketsuryugan - Discover & Share GIFs10 novembro 2024 -

PLAYING FAKE BLOXBURG GAMESfree bloxburg! (Roblox)10 novembro 2024

PLAYING FAKE BLOXBURG GAMESfree bloxburg! (Roblox)10 novembro 2024 -

Average Players Playing on Historical Data - Website Features10 novembro 2024

Average Players Playing on Historical Data - Website Features10 novembro 2024 -

A Complete Beginner Guide to Stickman Hook with Gameplay Tips-Game Guides-LDPlayer10 novembro 2024

A Complete Beginner Guide to Stickman Hook with Gameplay Tips-Game Guides-LDPlayer10 novembro 2024 -

SelfAzul on X: Veja quais são os primeiros sinais de #autismo em bebês. #infográfico #TEA #luzAzul #selfAzul #autismoerealidade / X10 novembro 2024

SelfAzul on X: Veja quais são os primeiros sinais de #autismo em bebês. #infográfico #TEA #luzAzul #selfAzul #autismoerealidade / X10 novembro 2024 -

David Coomer10 novembro 2024

-

Cheetos Futebol de Queijo • 40 G – Made in Market10 novembro 2024

Cheetos Futebol de Queijo • 40 G – Made in Market10 novembro 2024 -

ArtStation - One Piece Map10 novembro 2024

ArtStation - One Piece Map10 novembro 2024 -

10,246 Soccer Star Logo Images, Stock Photos, 3D objects, & Vectors10 novembro 2024

10,246 Soccer Star Logo Images, Stock Photos, 3D objects, & Vectors10 novembro 2024 -

Chemical toxicity and assumed safety10 novembro 2024

Chemical toxicity and assumed safety10 novembro 2024