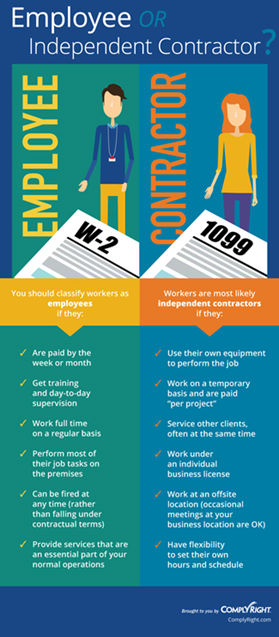

Independent Contractor: Definition, How Taxes Work, and Example

Por um escritor misterioso

Last updated 11 novembro 2024

:max_bytes(150000):strip_icc()/independent-contractor.asp-FINAL-6904c017dfbf4da18e90cf4db4af91e7.png)

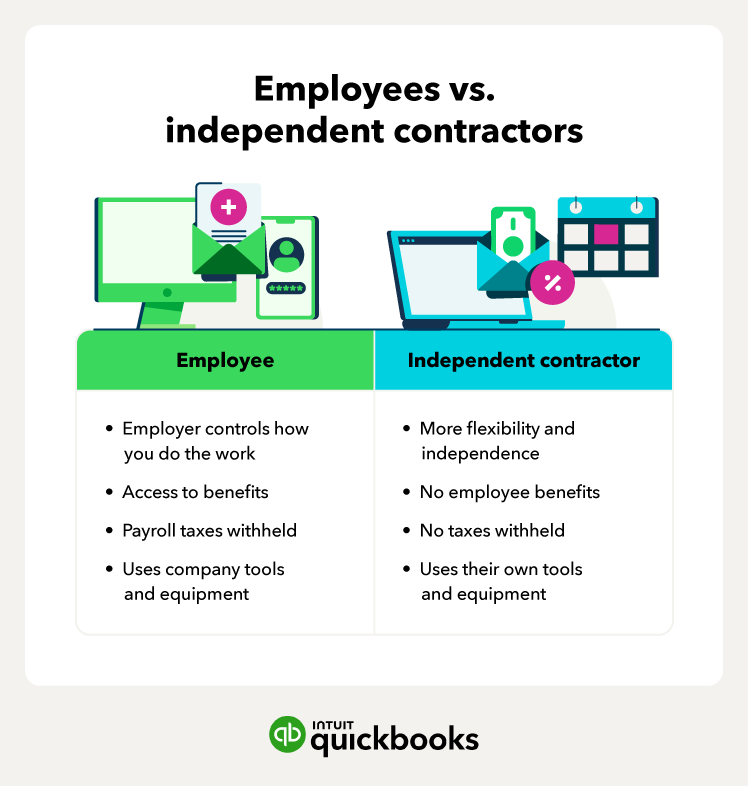

An independent contractor is a person or entity engaged in a work performance agreement with another entity as a non-employee.

How to file W-2 and 1099 together: Tax guide for 2024

What Is a 1099 Form, and How Do I Fill It Out?

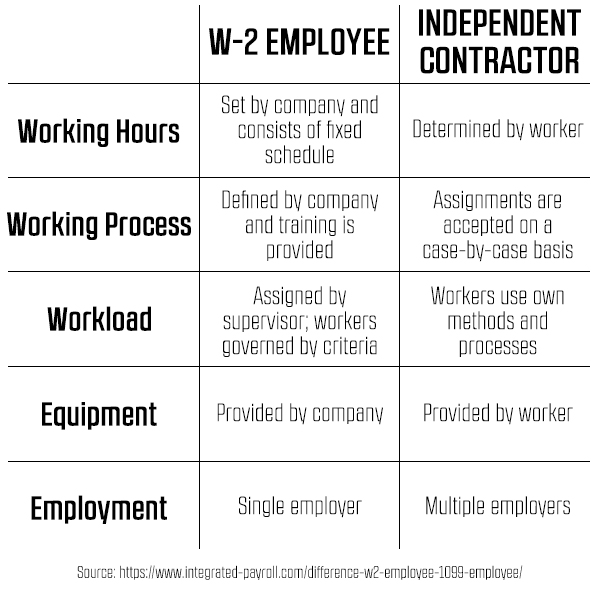

Do You Need a W-2 Employee or a 1099 Contractor? - How to Start

Easy Guide to Independent Contractor Taxes: California Edition

Guide to Taxes for Independent Contractors (2023)

The Independent Contractor Tax Rate: Breaking It Down • Benzinga

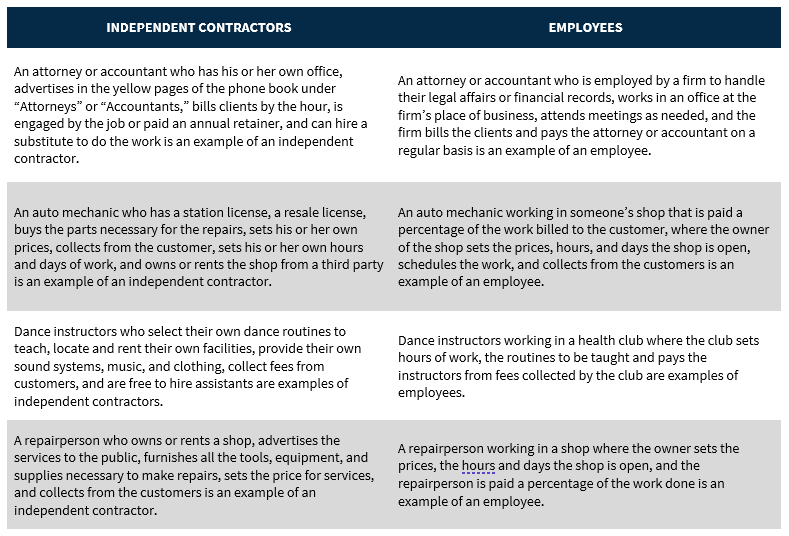

Independent Contractor vs. Employee: How Employers Can Tell the

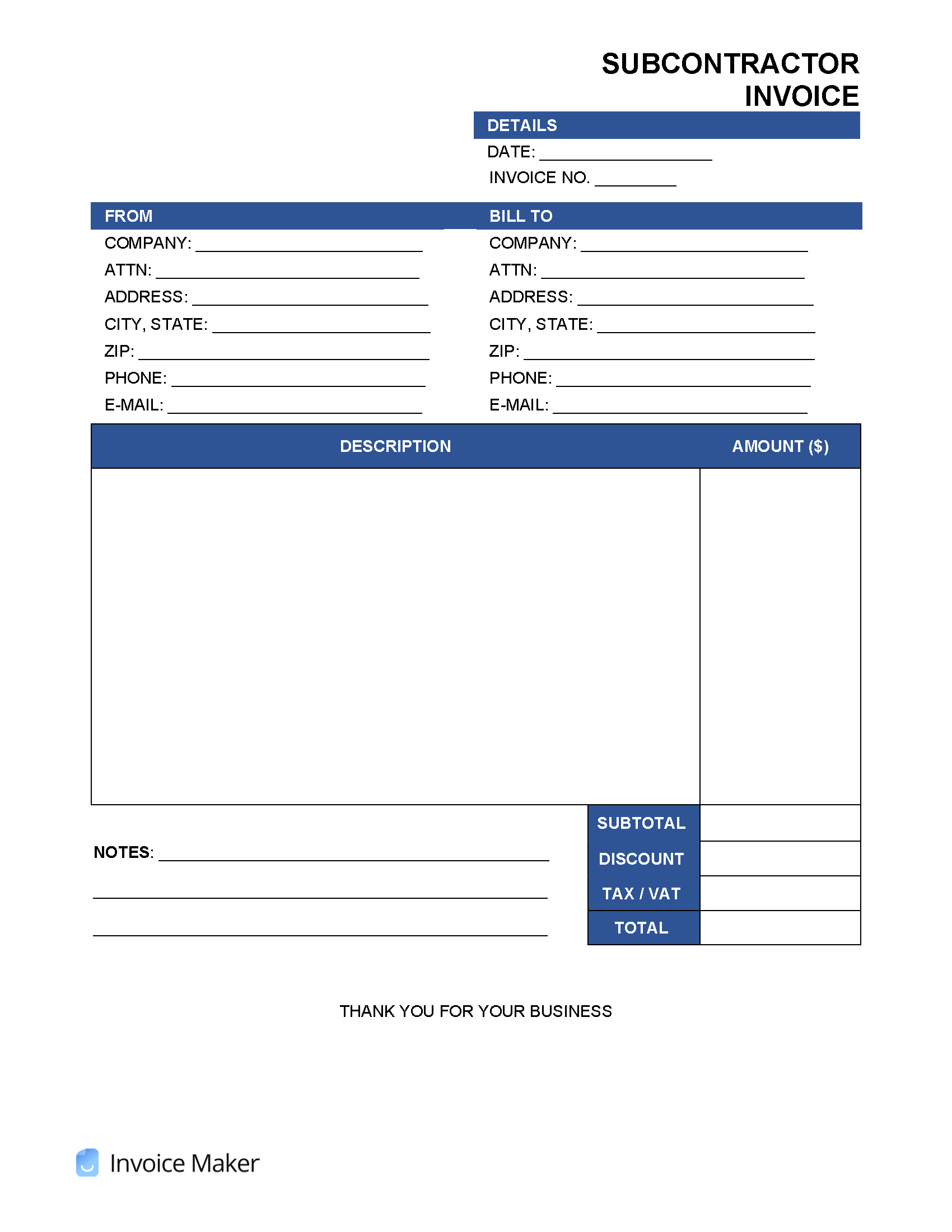

Independent Contractor (1099) Invoice Template

What is an Independent Contractor? Are They Employees?

Independent Contractor Expenses Spreadsheet [Free Template]

Attention Independent Contractors! Things To Consider For The New

How to Pay Tax As an Independent Contractor or Freelancer

Independent Contractor vs Employee: What's the Difference?

What does an employee lose when they work as an 'independent

Recomendado para você

-

:max_bytes(150000):strip_icc()/middle-class.asp-Final-dd68971263234dedb20170928f334461.png) Middle Class: Definition and Characteristics11 novembro 2024

Middle Class: Definition and Characteristics11 novembro 2024 -

Urban Dictionary Definition of a Violist Viola jokes, Urban dictionary, Violinist11 novembro 2024

Urban Dictionary Definition of a Violist Viola jokes, Urban dictionary, Violinist11 novembro 2024 -

Cambodian cuisine - Wikipedia11 novembro 2024

Cambodian cuisine - Wikipedia11 novembro 2024 -

Descriptor-Free Deep Learning QSAR Model for the Fraction Unbound in Human Plasma11 novembro 2024

-

Babylon - World History Encyclopedia11 novembro 2024

Babylon - World History Encyclopedia11 novembro 2024 -

Republican backed by Trump wins Louisiana governor's race, reclaims state for GOP11 novembro 2024

-

15-minute city - Wikipedia11 novembro 2024

15-minute city - Wikipedia11 novembro 2024 -

Americas - Wikipedia11 novembro 2024

Americas - Wikipedia11 novembro 2024 -

Arabian Peninsula - Wikipedia11 novembro 2024

Arabian Peninsula - Wikipedia11 novembro 2024 -

The urban definition of Room Temperature IQ : r/iamverysmart11 novembro 2024

The urban definition of Room Temperature IQ : r/iamverysmart11 novembro 2024

você pode gostar

-

FedEx Cup winner Justin Thomas to join new golf team owned by Arthur Blank – WSB-TV Channel 2 - Atlanta11 novembro 2024

FedEx Cup winner Justin Thomas to join new golf team owned by Arthur Blank – WSB-TV Channel 2 - Atlanta11 novembro 2024 -

Best Open World Games With Female Protagonists11 novembro 2024

Best Open World Games With Female Protagonists11 novembro 2024 -

Poppy Playtime Chapter 3 Guide APK for Android Download11 novembro 2024

Poppy Playtime Chapter 3 Guide APK for Android Download11 novembro 2024 -

Xenoblade Chronicles 3, All Monster Type Guide11 novembro 2024

Xenoblade Chronicles 3, All Monster Type Guide11 novembro 2024 -

Otherside Picnic, Otherside Picnic Wiki11 novembro 2024

Otherside Picnic, Otherside Picnic Wiki11 novembro 2024 -

TRADING VALUE TIER LIST FIRE FORCE ONLINE11 novembro 2024

TRADING VALUE TIER LIST FIRE FORCE ONLINE11 novembro 2024 -

Eminem - Mockingbird Lyrics T-Shirt | Essential T-Shirt11 novembro 2024

Eminem - Mockingbird Lyrics T-Shirt | Essential T-Shirt11 novembro 2024 -

Brasil x Canadá: onde assistir ao amistoso do futebol feminino11 novembro 2024

Brasil x Canadá: onde assistir ao amistoso do futebol feminino11 novembro 2024 -

Quanzhi Fashi - Ler mangá online em Português (PT-BR)11 novembro 2024

Quanzhi Fashi - Ler mangá online em Português (PT-BR)11 novembro 2024 -

10 ÓTIMOS DORAMAS NETFLIX FORA DA NETFLIX • E ONDE ASSISTIR? - PARTE 1/211 novembro 2024

10 ÓTIMOS DORAMAS NETFLIX FORA DA NETFLIX • E ONDE ASSISTIR? - PARTE 1/211 novembro 2024