What Is Social Security Tax? Definition, Exemptions, and Example

Por um escritor misterioso

Last updated 31 dezembro 2024

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

How did the Tax Cuts and Jobs Act change personal taxes?

Types of Taxes – Income, Property, Goods, Services, Federal, State

What is a payroll tax?, Payroll tax definition, types, and employer obligations

Social Security Tax Definition, How It Works, and Tax Limits

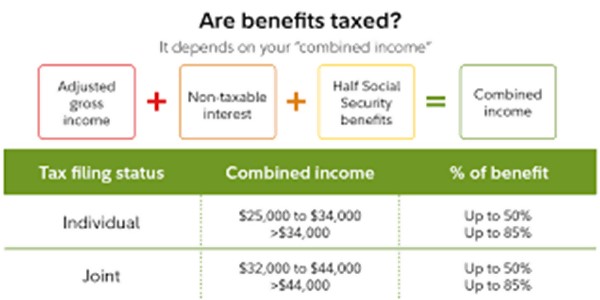

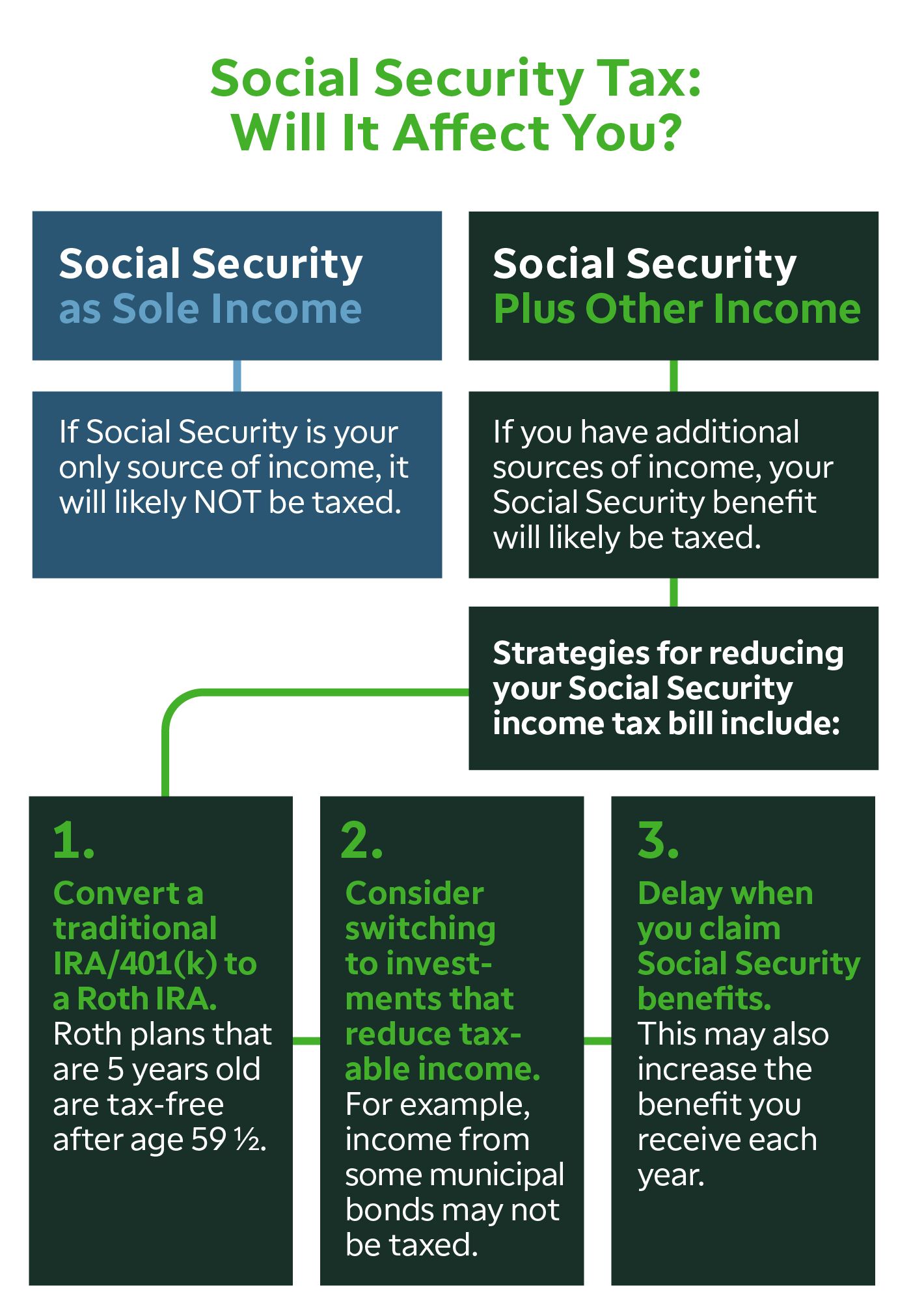

A Closer Look at Social Security Taxation - Jim Saulnier, CFP

Social Security Taxes: 3 Ideas to Help Minimize the I - Ticker Tape

Publication 915 (2022), Social Security and Equivalent Railroad Retirement Benefits

Figuring Out Your Form W-4: How Many Allowances Should You Claim?

What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status - Foundation Group®

Social Security (United States) - Wikipedia

Recomendado para você

-

Family Finance Favs: Don't Leave Teens Wondering What The FICA?31 dezembro 2024

Family Finance Favs: Don't Leave Teens Wondering What The FICA?31 dezembro 2024 -

Important 2020 Federal Tax Deadlines for Small Businesses - Workest31 dezembro 2024

Important 2020 Federal Tax Deadlines for Small Businesses - Workest31 dezembro 2024 -

Social Security and Medicare • Teacher Guide31 dezembro 2024

-

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes31 dezembro 2024

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes31 dezembro 2024 -

Overview of FICA Tax- Medicare & Social Security31 dezembro 2024

Overview of FICA Tax- Medicare & Social Security31 dezembro 2024 -

Employee Social Security Tax Deferral Repayment31 dezembro 2024

Employee Social Security Tax Deferral Repayment31 dezembro 2024 -

How Do I Get a FICA Tax Refund for F1 Students?31 dezembro 2024

How Do I Get a FICA Tax Refund for F1 Students?31 dezembro 2024 -

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com31 dezembro 2024

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com31 dezembro 2024 -

FICA Tax - An Explanation - RMS Accounting31 dezembro 2024

FICA Tax - An Explanation - RMS Accounting31 dezembro 2024 -

FICA Tax & Who Pays It31 dezembro 2024

FICA Tax & Who Pays It31 dezembro 2024

você pode gostar

-

Você já assistiu Hunter x Hunter?31 dezembro 2024

Você já assistiu Hunter x Hunter?31 dezembro 2024 -

![Jogador Caro [Explicit] : IGÃO LZ: Música Digital](https://m.media-amazon.com/images/I/61CDJmO3cyS._UXNaN_FMjpg_QL85_.jpg) Jogador Caro [Explicit] : IGÃO LZ: Música Digital31 dezembro 2024

Jogador Caro [Explicit] : IGÃO LZ: Música Digital31 dezembro 2024 -

Titan's ethnic wear brand 'Taneira' aims to have more than 80 stores by end of this fiscal31 dezembro 2024

Titan's ethnic wear brand 'Taneira' aims to have more than 80 stores by end of this fiscal31 dezembro 2024 -

NEW Monster Musume no Oisha-san Docter Vol.4 Japanese Version Novel Book Z-TON31 dezembro 2024

NEW Monster Musume no Oisha-san Docter Vol.4 Japanese Version Novel Book Z-TON31 dezembro 2024 -

Pet Simulator X, BIG Games Wiki31 dezembro 2024

Pet Simulator X, BIG Games Wiki31 dezembro 2024 -

Hunter x Hunter: PIE TO THE FACE - Anime, Hunter x hunter, Anime screenshots31 dezembro 2024

Hunter x Hunter: PIE TO THE FACE - Anime, Hunter x hunter, Anime screenshots31 dezembro 2024 -

The Game Awards Streaming Live December 7, 202331 dezembro 2024

The Game Awards Streaming Live December 7, 202331 dezembro 2024 -

Super saiyan GIF - Pesquisar em GIFER31 dezembro 2024

Super saiyan GIF - Pesquisar em GIFER31 dezembro 2024 -

Relógio Magnum Masculino Preto Couro Ma32952j em Promoção na Americanas31 dezembro 2024

Relógio Magnum Masculino Preto Couro Ma32952j em Promoção na Americanas31 dezembro 2024 -

Cortador Símbolo Garena 5,5cm – Cortadores da Lari31 dezembro 2024

Cortador Símbolo Garena 5,5cm – Cortadores da Lari31 dezembro 2024