FICA Tax: Understanding Social Security and Medicare Taxes

Por um escritor misterioso

Last updated 10 novembro 2024

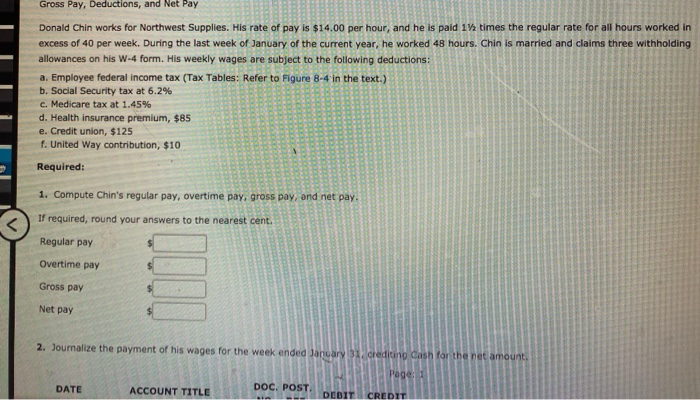

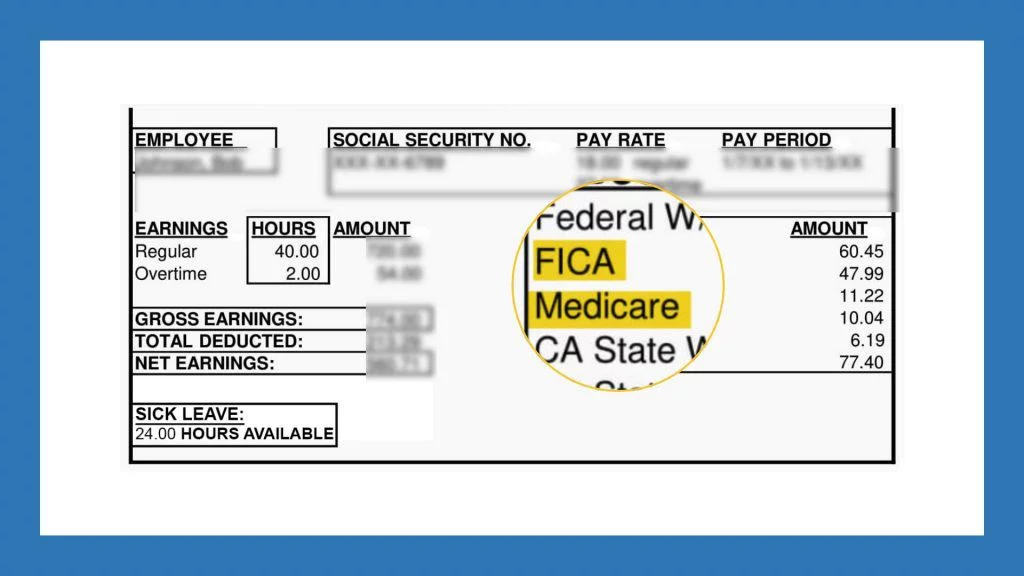

Both employees and employers are required to pay FICA tax, which is withheld from an employee

Solved Calculating Social Security and Medicare Taxes Assume

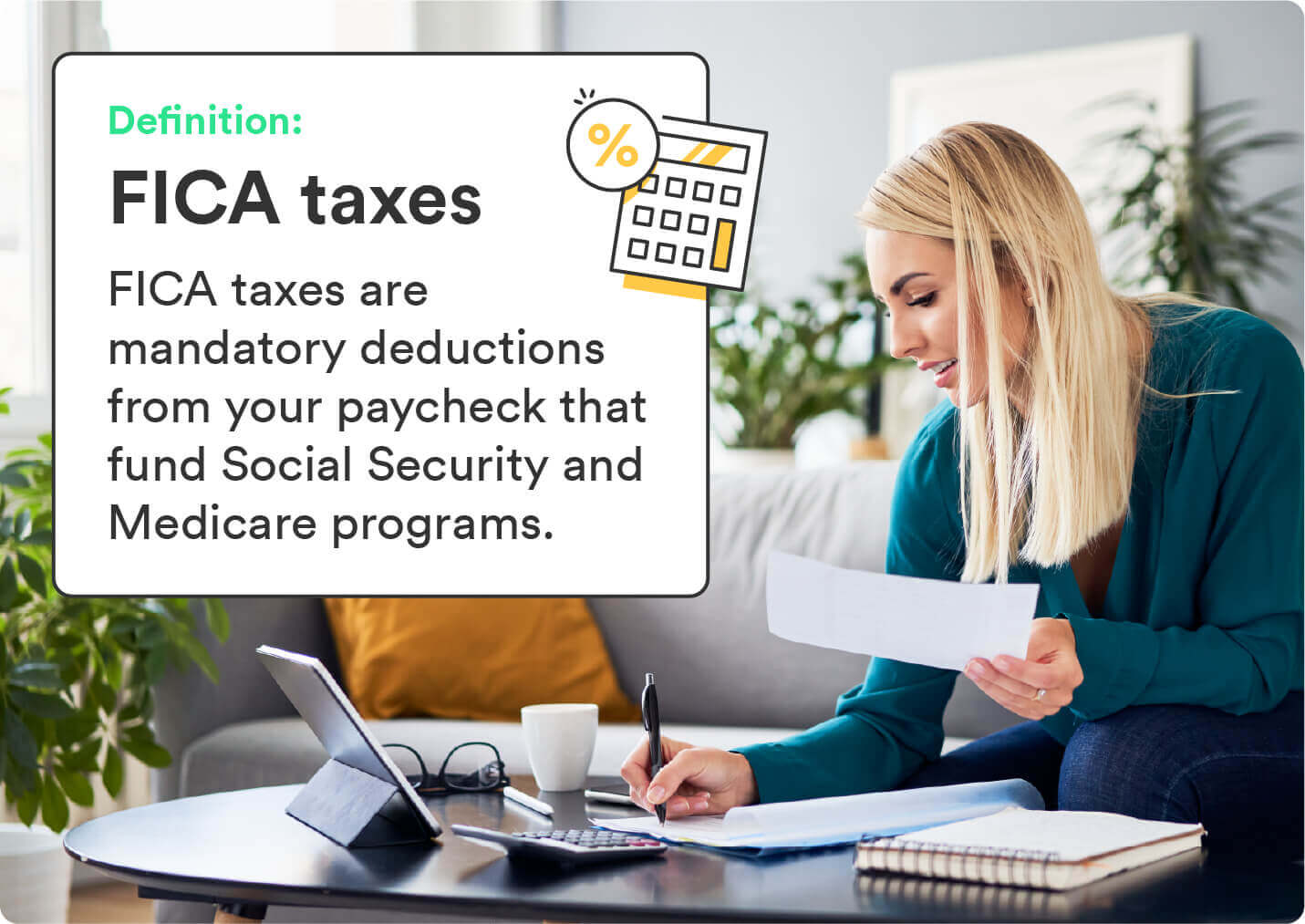

What Is FICA on a Paycheck? FICA Tax Explained - Chime

FICA Tax: Unraveling the Mystery Behind Social Security Contributions - FasterCapital

What is the FICA Tax? - 2023 - Robinhood

FICA Tax: What It is and How to Calculate It

Understanding Your Paycheck

Social Security wage base is $160,200 in 2023, meaning more FICA taxes for higher earners - Don't Mess With Taxes

Understanding payroll tax & how to calculate it

FICA Tax in 2022-2023: What Small Businesses Need to Know

Understanding FICA (Social Security and Medicare) Taxes - MyIRSteam

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

The FICA Tax: How Social Security Is Funded – Social Security Intelligence

Recomendado para você

-

FICA Tax: 4 Steps to Calculating FICA Tax in 202310 novembro 2024

FICA Tax: 4 Steps to Calculating FICA Tax in 202310 novembro 2024 -

Overview of FICA Tax- Medicare & Social Security10 novembro 2024

Overview of FICA Tax- Medicare & Social Security10 novembro 2024 -

2023 FICA Tax Limits and Rates (How it Affects You)10 novembro 2024

2023 FICA Tax Limits and Rates (How it Affects You)10 novembro 2024 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand10 novembro 2024

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand10 novembro 2024 -

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents10 novembro 2024

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents10 novembro 2024 -

Do You Have To Pay Tax On Your Social Security Benefits?10 novembro 2024

Do You Have To Pay Tax On Your Social Security Benefits?10 novembro 2024 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software10 novembro 2024

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software10 novembro 2024 -

FICA Tax in 2022-2023: What Small Businesses Need to Know10 novembro 2024

FICA Tax in 2022-2023: What Small Businesses Need to Know10 novembro 2024 -

What is the FICA Tax Refund? - Boundless10 novembro 2024

What is the FICA Tax Refund? - Boundless10 novembro 2024 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine10 novembro 2024

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine10 novembro 2024

você pode gostar

-

Games10 novembro 2024

Games10 novembro 2024 -

Get the Latest Opera GX Browser10 novembro 2024

-

1M PEOPLE PLAYING BROOKHAVEN?! : r/roblox10 novembro 2024

1M PEOPLE PLAYING BROOKHAVEN?! : r/roblox10 novembro 2024 -

trans c!fundy because he's pretty pog 😌🏳️⚧️ may or may not be posting more pride dsmp stuff throughout the month (ie. eret, puffy, maybe…10 novembro 2024

-

Kaifuku Jutsushi no Yarinaoshi Brasil - ala q otario kkkkkkkkkkk 2 vezes10 novembro 2024

-

MIUI 15 terá uma nova app para o Relógio Xiaomi - 4gnews10 novembro 2024

MIUI 15 terá uma nova app para o Relógio Xiaomi - 4gnews10 novembro 2024 -

Sudden Attack — StrategyWiki Strategy guide and game reference wiki10 novembro 2024

Sudden Attack — StrategyWiki Strategy guide and game reference wiki10 novembro 2024 -

Painel Decoração Retangular Tecido Sublimado Fazendinha Aquarela 1,50x2,20 - Decoração Infantil10 novembro 2024

Painel Decoração Retangular Tecido Sublimado Fazendinha Aquarela 1,50x2,20 - Decoração Infantil10 novembro 2024 -

Confira festas para curtir o Halloween em Porto Alegre no final de semana10 novembro 2024

Confira festas para curtir o Halloween em Porto Alegre no final de semana10 novembro 2024 -

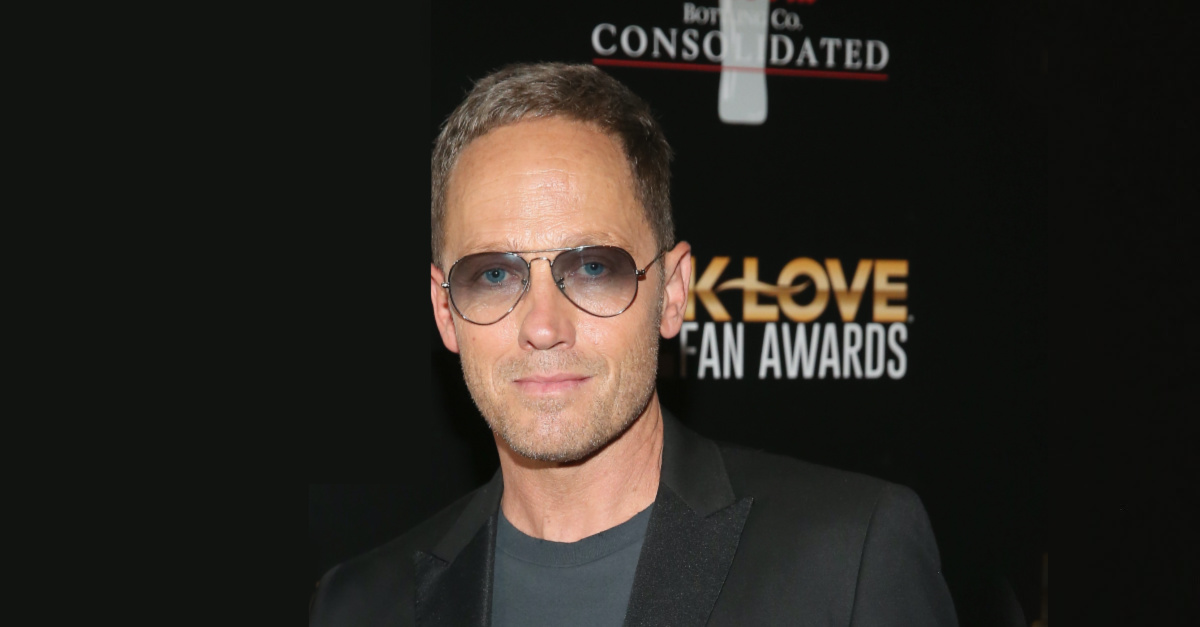

TobyMac Releases First Album Since Son's Death: 'God Didn't Leave10 novembro 2024

TobyMac Releases First Album Since Son's Death: 'God Didn't Leave10 novembro 2024