Withholding FICA Tax on Nonresident employees and Foreign Workers

Por um escritor misterioso

Last updated 10 novembro 2024

The proper determination of FICA tax exemption for nonresident employees has become particularly tricky for payroll staff in organizations across the US. In this guide, we share some tips for effective management of nonresident payroll.

Which visa holders are exempt from Social Security and Medicare taxes?

Who Is Exempt from Paying Social Security Tax? - TurboTax Tax Tips

Which Employees Are Exempt From Tax Withholding?

Which Employees Are Exempt From Tax Withholding?

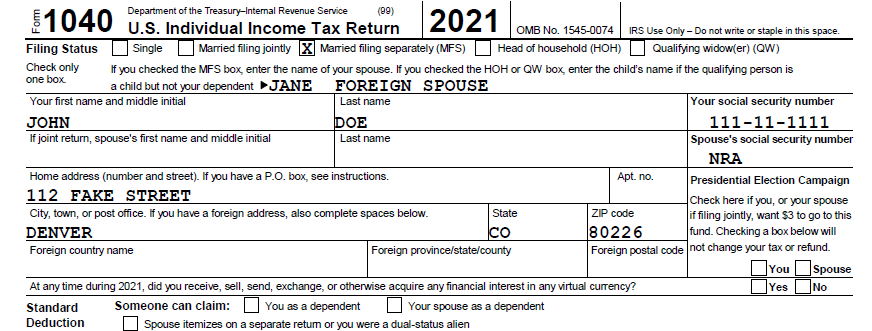

Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If

Canadian here What are FICA taxes - Blind

What is the FICA Tax? - 2023 - Robinhood

A Guide to International Taxes when Working Remotely

FICA Tax Exemption for Nonresident Aliens Explained

How to avoid paying U.S. Social Security tax when working overseas

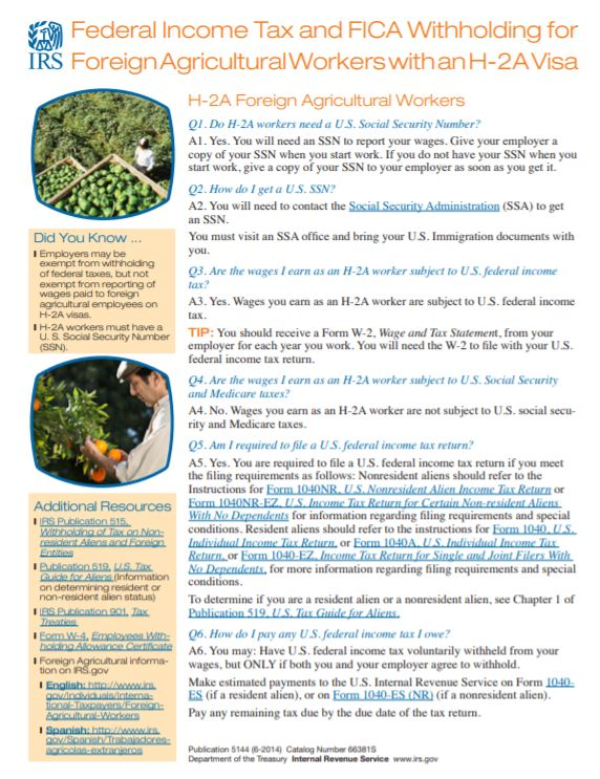

Federal Income Tax and FICA Withholding for Foreign Agricultural

BambooHR Glossary: FICA

How to read your W-2 University of Colorado

Recomendado para você

-

What is FICA Tax? - Optima Tax Relief10 novembro 2024

What is FICA Tax? - Optima Tax Relief10 novembro 2024 -

What Is FICA Tax: How It Works And Why You Pay10 novembro 2024

What Is FICA Tax: How It Works And Why You Pay10 novembro 2024 -

Family Finance Favs: Don't Leave Teens Wondering What The FICA?10 novembro 2024

Family Finance Favs: Don't Leave Teens Wondering What The FICA?10 novembro 2024 -

What Is the FICA Tax and Why Does It Exist? - TheStreet10 novembro 2024

What Is the FICA Tax and Why Does It Exist? - TheStreet10 novembro 2024 -

Overview of FICA Tax- Medicare & Social Security10 novembro 2024

Overview of FICA Tax- Medicare & Social Security10 novembro 2024 -

FICA Refund: How to claim it on your 1040 Tax Return?10 novembro 2024

FICA Refund: How to claim it on your 1040 Tax Return?10 novembro 2024 -

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet10 novembro 2024

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet10 novembro 2024 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations10 novembro 2024

What is a payroll tax?, Payroll tax definition, types, and employer obligations10 novembro 2024 -

IRS Form 843 - Request a Refund of FICA Taxes10 novembro 2024

IRS Form 843 - Request a Refund of FICA Taxes10 novembro 2024 -

Understanding FICA Taxes and Wage Base Limit10 novembro 2024

Understanding FICA Taxes and Wage Base Limit10 novembro 2024

você pode gostar

-

Mortal Kombat 12 revelado em PlayStation Showcase de maio10 novembro 2024

Mortal Kombat 12 revelado em PlayStation Showcase de maio10 novembro 2024 -

GitHub - sawyerpollard/MineWeather: Chrome Extension that displays a Minecraft scene on New Tabs depending on local weather conditions.10 novembro 2024

GitHub - sawyerpollard/MineWeather: Chrome Extension that displays a Minecraft scene on New Tabs depending on local weather conditions.10 novembro 2024 -

Naruto Teases Epic Jiraiya vs Urashiki Battle10 novembro 2024

Naruto Teases Epic Jiraiya vs Urashiki Battle10 novembro 2024 -

Eve Online - Gameplay 110 novembro 2024

Eve Online - Gameplay 110 novembro 2024 -

Rokudenashi Majutsu Koushi to Akashic Records - Rel Rayford10 novembro 2024

Rokudenashi Majutsu Koushi to Akashic Records - Rel Rayford10 novembro 2024 -

Atlas - Brasil: As cinco regiões brasileiras em fatos e números - Guia do Estudante10 novembro 2024

Atlas - Brasil: As cinco regiões brasileiras em fatos e números - Guia do Estudante10 novembro 2024 -

Personalidades da música mineira revelam seus jogos marcantes na10 novembro 2024

Personalidades da música mineira revelam seus jogos marcantes na10 novembro 2024 -

Link's Awakening | Amiibo COIN for Switch Link's Awakening The Legend of Zelda10 novembro 2024

Link's Awakening | Amiibo COIN for Switch Link's Awakening The Legend of Zelda10 novembro 2024 -

Chui Leilões » 252ª Ciretran de Jandira10 novembro 2024

Chui Leilões » 252ª Ciretran de Jandira10 novembro 2024 -

wh humor :: Cat Girl :: Space Marine (Adeptus Astartes) :: Wh10 novembro 2024

wh humor :: Cat Girl :: Space Marine (Adeptus Astartes) :: Wh10 novembro 2024